Billionaire KP Singh has sold his entire remaining stake in real estate firm DLF for around Rs 731 crore, according to the stock exchange data.

It wasn’t clear why Singh, who in June 2020 was named the chairman emeritus, sold the shares in the company that is now headed by his son Rajiv.

According to bulk deal data on BSE, Kushal Pal Singh, one of the promoters, sold 1,44,95,360 shares on the stock exchange at Rs 504.21 each, totalling Rs 731 crore.

DLF’s share opened at Rs 510 per share on BSE but closed 3.65 per cent down at Rs 499.70 apiece from the Monday closing price following the sale of a large number of shares by one of the promoters.

Its market cap stood at Rs 1,23,691 crore on Tuesday’s closing price.

As per the DLF’s shareholding pattern as on June 30, 2023, 93-year-old Singh held 1,44,95,360 shares, which is equivalent to 0.59 per cent shareholding in the company.

Promoters group held a 74.95 per cent stake in the company at the end of the June quarter.

In June 2020, Singh retired as the company’s chairman after nearly six decades in business.

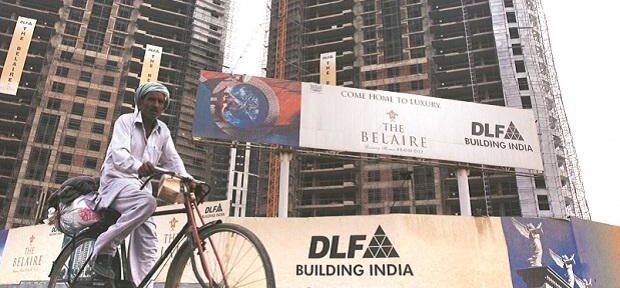

Having transformed Delhi Land & Finance Limited (DLF) into India’s biggest listed property firm, he handed over the reins to his son Rajiv Singh.

The DLF Chairman Emeritus had left an army job in 1961 to join DLF — a company started by his father-in-law in 1946.

Singh, credited for the pre-eminence of Gurugram (erstwhile Gurgaon), is a science graduate from Meerut College.

He studied engineering in the United Kingdom and then served as an officer in an elite cavalry regiment in the Indian Army. He left the military to join his father-in-law, entrepreneur Chaudhary Raghvendra Singh’s firm DLF.

Under his leadership, DLF expanded beyond Gurgaon, building apartments, shopping malls, and hotels. In 2007, he oversaw DLF’s much-anticipated initial public offering, which raised Rs 9,188 crore through the sale of 17.5 crore shares.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)