The GST Council on July 11 decided that online gaming is an actionable claim, like the lottery, on which a 28 per cent tax is to be levied. The finance ministry on Tuesday said there are sufficient enforcement provisions in GST laws to take action against offshore gaming platforms, which default in paying taxes.… Continue reading Current law enough against GST evasion by offshore gaming platforms: FinMin

Tag: GST

Govt stands firm on its decision to levy 28% GST on e-gaming, casinos

The government officials clarified that so long as money is involved in a game, govt will make no distinction between a game of skill and a game of chance The government officials have clarified that the proposed 28 per cent goods and services tax (GST) on online gaming and casinos is here to stay,… Continue reading Govt stands firm on its decision to levy 28% GST on e-gaming, casinos

GST evasion, money laundering, bank fraud cases & more

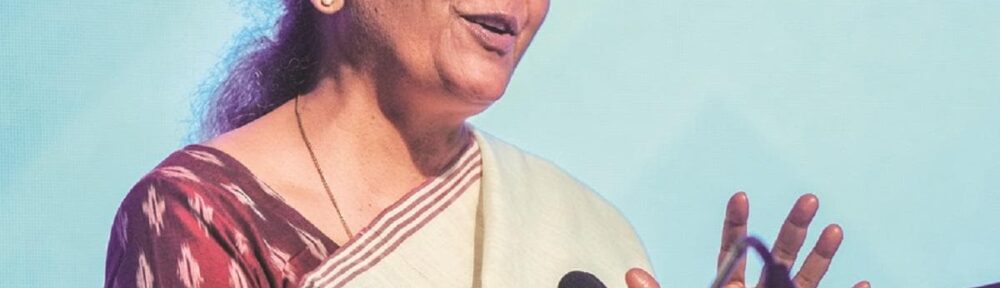

Rs. 14,302 cr of GST evasion detected in April, May As many as 2,784 cases of GST evasion involving Rs. 14,302 crore were detected in the first two months of the current financial year, while Rs. 5,716 crore was recovered during the period, Parliament was informed on Monday. Finance Minister Nirmala Sitharaman in… Continue reading GST evasion, money laundering, bank fraud cases & more

GST evasion of Rs 14,302 cr detected in April-May, 28 persons arrested

As many as 2,784 cases of GST evasion involving Rs 14,302 crore were detected in the first two months of the current fiscal, while Rs 5,716 crore was recovered during the period, Parliament was informed on Monday. Finance Minister Nirmala Sitharaman in a written reply in the Lok Sabha gave details of Goods… Continue reading GST evasion of Rs 14,302 cr detected in April-May, 28 persons arrested

CBIC deserves kudos for GST clarificatory circulars

The Central Board of Indirect Taxes and Customs (CBIC) issued eight circulars on July 17, 2023, following the 50th GST Council meeting held on July 11, 2023. They clarify a number of issues and generally convey a desire on the part of administrators to avoid unnecessary disputes to the extent possible. The… Continue reading CBIC deserves kudos for GST clarificatory circulars