Ahead of its second anniversary, Tata Neu, the multi-purpose super app of the Tata group is refreshing its design, and may also venture into the online food delivery space by leveraging the Open Network for Digital Commerce (ONDC), sources said. The salt-to-steel conglomerate’s ambitious e-commerce project has embarked on a sleek, immersive design,… Continue reading Tata Neu changes its look with a new UI, eyes online food delivery foray | Company News

Tag: Online

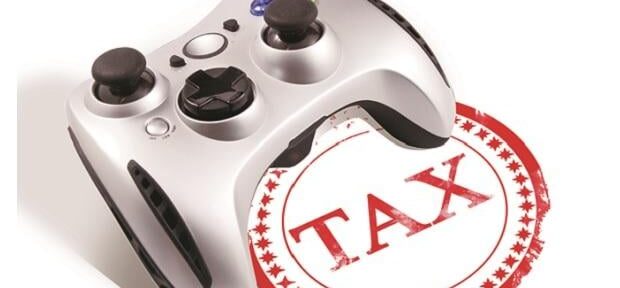

GST levy on online gaming may not impact taxation on e-sports, video games

The recently imposed 28 per cent goods and services tax (GST) on online games involving real money will not impact the taxation on e-sports, such as FIFA Online and League of Legends, or leading titles on PlayStation, Xbox and Nintendo platforms. The higher tax rate will be solely levied to pay-to-win games, such… Continue reading GST levy on online gaming may not impact taxation on e-sports, video games

Sebi provides clarity on online resolution of disputes framework

After exhausting these options for resolution of the grievance, if the investor is still not satisfied with the outcome, he/she can initiate dispute resolution through the Online Dispute Resolution (ODR) portal, Sebi said in a circular. Capital markets regulator Sebi on Friday provided more clarity on the framework concerning online resolution of disputes in… Continue reading Sebi provides clarity on online resolution of disputes framework

28% tax on online gaming from October 1, says Sitharaman

A 28 per cent tax on the full face value of bets placed on online gaming will be imposed from October 1, Finance Minister Nirmala Sitharaman said during the 51st GST Council meeting. The GST Council will review the implementation of a 28 per cent goods and services tax (GST) on online gaming… Continue reading 28% tax on online gaming from October 1, says Sitharaman

28% GST on online gaming to be implemented from October 1: FM Sitharaman

Softening its stance, the Goods and Services Tax (GST) Council on Wednesday decided to implement a 28 per cent tax on electronic gaming, casinos, and horse racing, but this would be applied on the initial amount paid upon entry, and not on the total value of each bet placed. Despite dissent from… Continue reading 28% GST on online gaming to be implemented from October 1: FM Sitharaman

Tweaks to GST Act must factor in law banning online gambling: TN to Centre

In the proposed amendment to the GST Act and Rules to tax online gaming, suitable modifications should be made by taking into account the state law banning online gambling, the Tamil Nadu government conveyed to the GST Council on Wednesday. In the 51st GST Council meeting, Tamil Nadu Finance Minister Thangam Thennarasu expressed… Continue reading Tweaks to GST Act must factor in law banning online gambling: TN to Centre

Piyush Goyal meet e-commerce firms, CAIT to discuss online retail issues

Commerce and Industry Minister Piyush Goyal on Wednesday held a detailed discussion with representatives of e-commerce firms and domestic traders body CAIT on issues related to the sector, including the proposed policy, an official said. Confederation of All India Traders (CAIT) Secretary General Praveen Khandelwal, who attended the meeting, said that it was… Continue reading Piyush Goyal meet e-commerce firms, CAIT to discuss online retail issues

Delhi finance minister ‘strongly opposed’ to 28% GST levy on online gaming

Delhi finance minister Atishi has “strongly opposed” the GST Council’s decision to implement a 28 per cent GST on online gaming platforms, an official statement said on Wednesday. The GST Council chaired by Union finance minister Nirmala Sitharaman on Wednesday decided that 28 per cent GST will be levied at face value of… Continue reading Delhi finance minister ‘strongly opposed’ to 28% GST levy on online gaming

Small firms in online money gaming will be unable to survive high GST: AIGF

Small companies that are into online real money-based gaming will not be able to survive due to the high Goods and Services Tax of 28 per cent, industry body All India Gaming Federation said on Wednesday. Finance Minister Nirmala Sitharaman has announced that a 28 per cent GST on the full face value… Continue reading Small firms in online money gaming will be unable to survive high GST: AIGF

Indians spent Rs 5,000 crore on cosmetics in 6 months, mostly online: Study

Within the past six months, over 100 million cosmetic items, ranging from lipstick and nail polish to eyeliner have been sold, generating a revenue of Rs 5,000 crore, with nearly 40 per cent of these purchases occurring online, according to Economic Times. These trends were recorded through a study by Kantar Worldpanel. Key… Continue reading Indians spent Rs 5,000 crore on cosmetics in 6 months, mostly online: Study