A combination of policy changes such as bankruptcy law and taxation code and the enabling environment created by the digital public infrastructure has made India an attractive investment destination for the financial technology sector, a senior World Economic Forum (WEF) official said. In a video interview with PTI, Matthew Blake, Head of the… Continue reading DPI, tax code make India attractive investment destination: WEF official | Economy & Policy News

Tag: tax

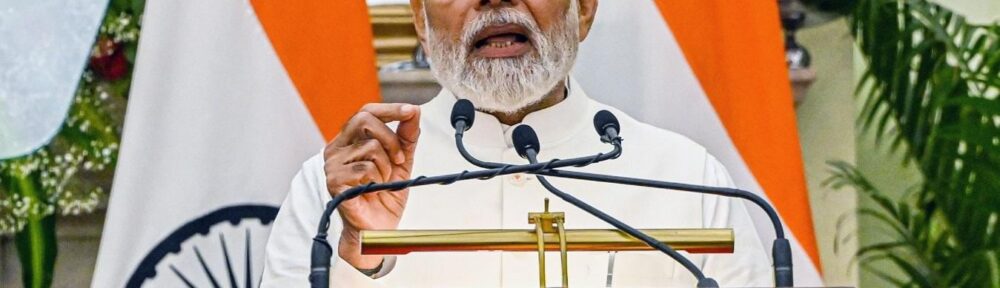

We changed perception tax paid by citizens is squandered in corruption: PM

Prime Minister Narendra Modi on Sunday asserted that his government has changed the perception that the tax paid by citizens is squandered in corruption and said the 16 per cent increase in the number of people filing income tax returns this year shows the growth of trust in the dispensation. Addressing an event… Continue reading We changed perception tax paid by citizens is squandered in corruption: PM

Affle India’s profit after tax rises over 21% to Rs 66.2 cr in April-June

Global technology company Affle (India) Limited on Saturday reported a 21.4 per cent rise in its profit after tax at Rs 66.4 crore in the April-June quarter of this fiscal. The company promoted by Singapore-based Affle Holdings had registered a profit after tax (PAT) of Rs 54.5 crore in the first quarter of… Continue reading Affle India’s profit after tax rises over 21% to Rs 66.2 cr in April-June

CAMS reports 18% rise in profit after tax to Rs 76 cr in June quarter

Its revenue rose 10.4 per cent to Rs 261.3 crore in the quarter under review from Rs 236.65 crore in the April-June quarter of 2021. Registrar and transfer agent for mutual funds CAMS on Friday reported an 18 per cent growth in profit after tax (PAT) to Rs 76.34 crore for the June quarter.… Continue reading CAMS reports 18% rise in profit after tax to Rs 76 cr in June quarter

India might cut or abolish wheat import tax: Food Secretary Sanjeev Chopra

India in June imposed a limit on the amount of wheat stocks traders can hold, for the first time in 15 years, to bring down prices. By Mayank Bhardwaj NEW DELHI (Reuters) -India is considering cutting or abolishing import taxes on wheat, Food Secretary Sanjeev Chopra said on Friday, as the world’s second-biggest… Continue reading India might cut or abolish wheat import tax: Food Secretary Sanjeev Chopra

28% tax on online gaming from October 1, says Sitharaman

A 28 per cent tax on the full face value of bets placed on online gaming will be imposed from October 1, Finance Minister Nirmala Sitharaman said during the 51st GST Council meeting. The GST Council will review the implementation of a 28 per cent goods and services tax (GST) on online gaming… Continue reading 28% tax on online gaming from October 1, says Sitharaman

Chinese carmaker BYD faces investigation for underpaying tax in India: Rpt

Chinese automaker BYD faces an ongoing Indian investigation over allegations that it paid too little tax on imported parts for cars it assembles and sells in the country, two sources with direct knowledge of the matter said. India’s Directorate of Revenue Intelligence (DRI) has alleged that China’s largest electric vehicle (EV) maker, whose… Continue reading Chinese carmaker BYD faces investigation for underpaying tax in India: Rpt

Top headlines: Fitch cuts US credit rating, corporation tax mop-up slips

Business Standard brings you the top headlines at this hour Source link

Corporation tax mop-up slips 14%; total tax collection in Q1 rises 3.38%

Premium The decline in the third month slowed due to the advance tax collections that month. Collections from the corporation tax declined nearly 14 per cent year-on-year (YoY) to Rs 1.38 trillion in the first quarter of this financial year (Q1FY24), from Rs 1.61 trillion, despite signs of economic recovery. The revenue under this… Continue reading Corporation tax mop-up slips 14%; total tax collection in Q1 rises 3.38%

Tax filing for AY24 touches all-time high, surpasses 67.7 million

Tax filings for the assessment year (AY) 2023-24 have hit a record high, exceeding 67.7 million. This figure represents a 16.1 per cent increase compared to the total tax returns filed during the previous assessment year, according to an announcement by the revenue department on Tuesday. For AY23, the department received 58.3 million… Continue reading Tax filing for AY24 touches all-time high, surpasses 67.7 million